Expense Manager 3.10.2

Free Version

When apps get too curious

Digital budget managers tend to add in all sorts of little features in order to please potential long term users. This is usually evident in the most common function, "add expense". Besides amount, date and category, we get a lot of extra details that I personally don't bother to fill in. I mean, adding in transactions is a chore in itself if you want to have an accurate depiction of your cash flow. But I don't mind the possibility to do so. In case of Expense Manager & Money Saver however, I would mind, and here's why.

Expense Manager & Money Saver (also known as Gullak Expense manager) requires a handful of device privileges when installing, including Identity, and invites you to create an account in order to make sure your data stays safe and whatnot. Now, when I saw that this app has a borrow/lend function that interacts with your contact list, I decided to stay away. It's true that in the current year, we give off personal information here and there on the net, but there are some limits when it comes to more sensitive subjects. Now that I've dealt with my beef, how does Expense Manager fare?

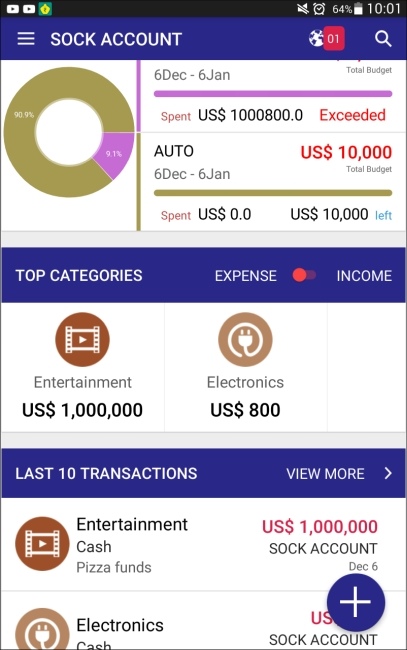

Expense Manager supports multiple accounts, although visually, each account is considered to be a different user and there is no way to compare different accounts into one graph or breakdown. You can however transfer funds between them, which will register as income or expense for each. With that said, there is no possibility to tag accounts as bank or cash and frankly, finding how to create an account requires some searching around.

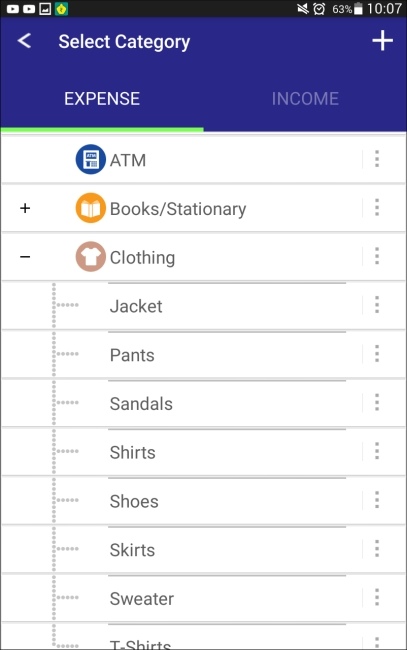

As you probably expected, The expense/income dialog is very thorough, but you are not expected to use more than the net sum. However categories can be edited and new ones can be created. Each category can have a set of subcategories that can really help you (and whoever is watching) review things in detail.

Besides income and expense, the app also lets you add in bills. This is where localization comes in. The bill categories are fixed and the service details are limited to operators in India, unless you select the generic Other every time. Local users can actually pay legitimate bills if they fill in correct invoice data. However, bills can also simply be marked as paid, in which case they convert into a regular expense transaction and modify your account accordingly. The bills feature can also set reminders.

With Expense Manager you can also set budgets. However, they do not encapsulate multiple accounts, so they're fairly useless in my opinion... unless you want a budget for ice cream... and you always pay for ice cream from the same pocket.

There are also some extra features like bill splitting/sharing, special offers, and Trnx stocks management(?).

Features

- Accounts and transfers

- Billing manager

- Lending/borrowing

- Account focused budgets

- Reminders

- Expense reimbursing feature

- Bill splitting/sharing (exclusive to India)

- Stock market management (exclusive to India)

Conclusion

Gullak Expense Manager is clearly catering to the Indian user base. Leaving that aside, I didn't find a very convincing app. The limited account functionality and lack of billing customization (for international users) is enough to leave me cold. I like the expense/income category customization though. However I don't like a financial app looking at my contact list.

Our Recommendations